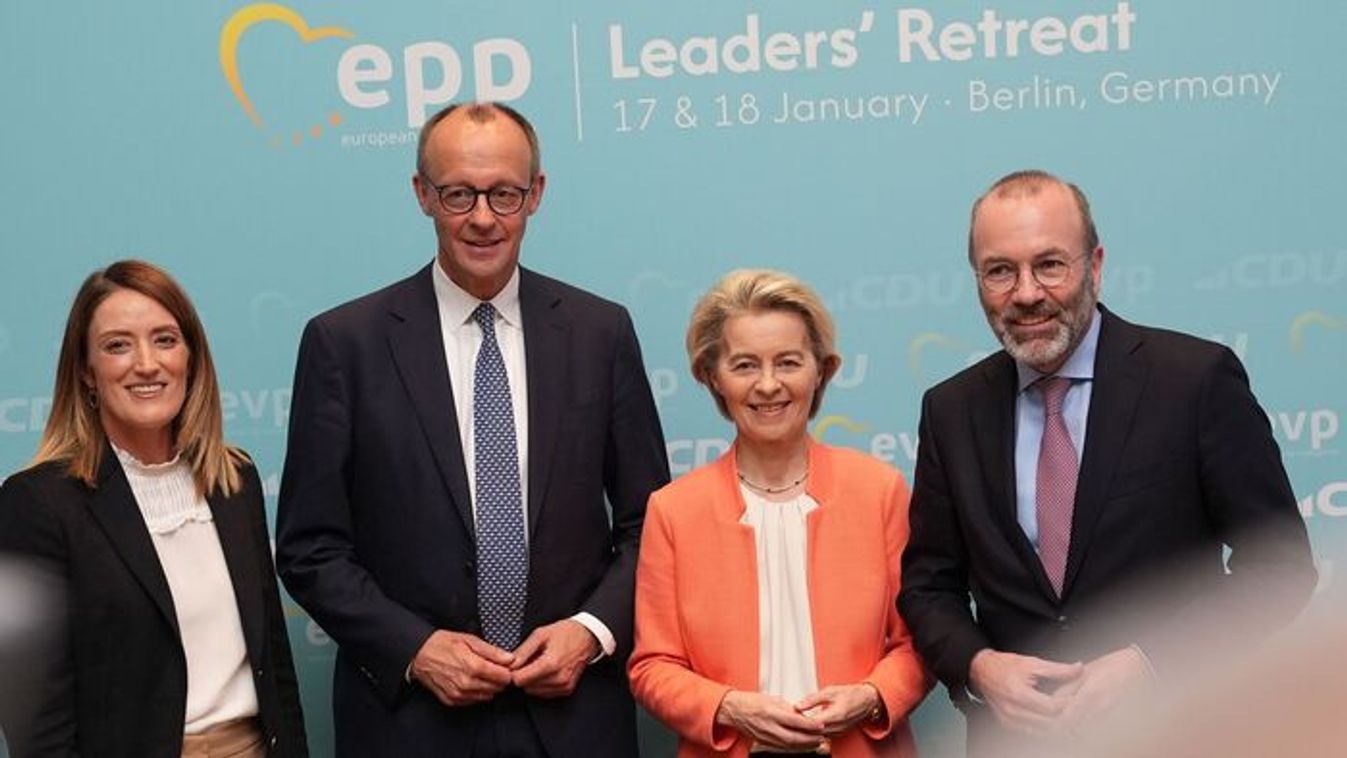

Két út áll az Európai Unió előtt: az egyik a történet végét jelentené

Egyre világosabb, Orbán Viktor miért hangoztatja régóta, hogy a brüsszeli politika irányát meg kell változtatni.

How social entrepreneurs can work with corporate organisations to create new ways of raising finance.

„Social entrepreneurs often struggle with the dilemma of how to raise finance. Should they be a charity, and seek donations? Or a business and look for commercial funding? They are driven by a social mission, but traditional philanthropy doesn't provide them with a stable, long term source of finance. At the same time, commercial investors neither understand nor trust them, many believing that »social« means »soft« and is usually a polite word for »loss-making«.(...)

Four years ago, Fair Finance was caught in the dilemma described above – it had started life funded entirely through local authority grants and contracts, but now both were being cut. Fair Finance needed to access a different source of funding to grow, but the organisation wasn't set up to raise equity and, although financially sustainable, couldn't offer the kind of financial returns most venture capitalists would be looking for anyway.

What did Fair Finance do? It raised funds through its own bespoke financial instrument, one tailored exactly to the needs of the business. Fair Finance raised a loan offering a modest, single digit rate of interest and a flexible repayment profile which is based on a percentage of the profits produced by the business over the next seven years. If the business does well, the loan will repay quicker. If the business experiences a slow-down, the loan takes longer to repay, but cannot default.”